Vinod Khosla's Venture Capital Fortune Blossomed Early from Sun

By James Moreau | 01 May, 2025

The venture legend's early bets on OpenAI & DoorDash helped power Khosla Ventures' $15B AUM and his $7.7 Bil. personal worth.

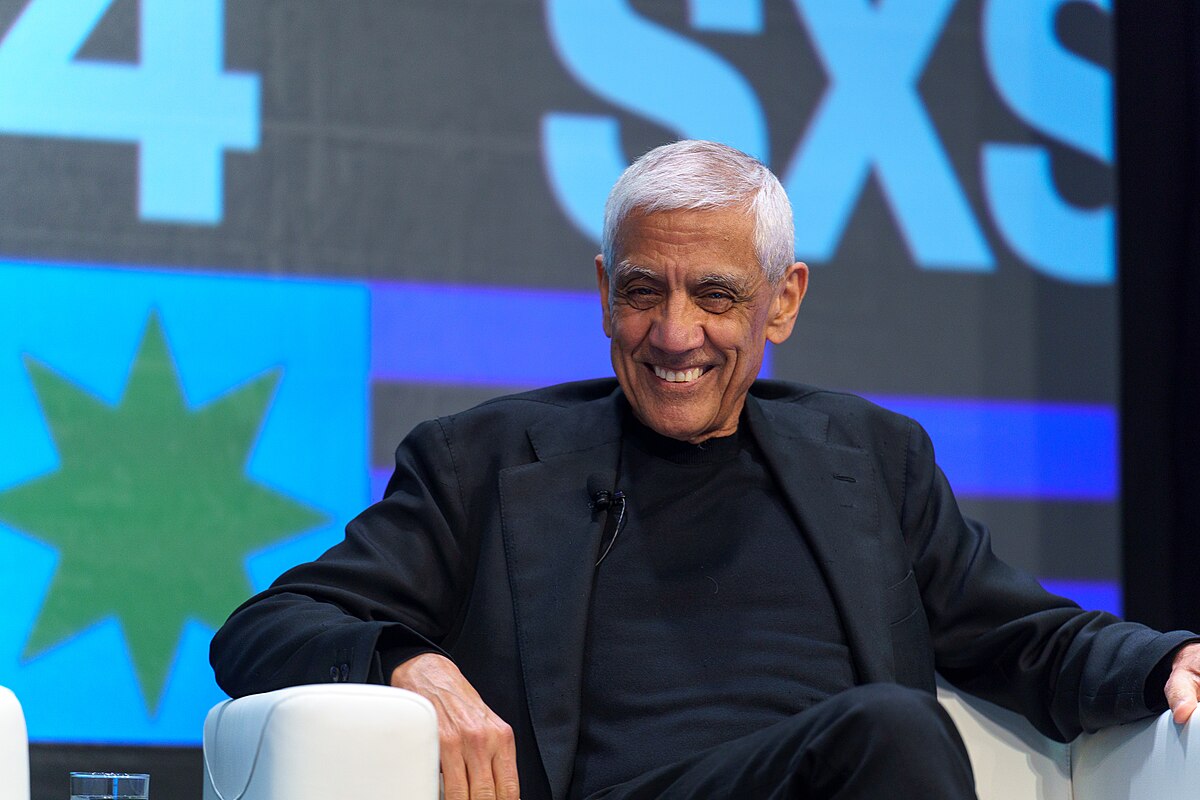

Vinod Khosla is widely considered the second most successful Asian American venture capitalist, with a $7.7 billion net worth acquired mainly through successful investments by his Khosla Ventures.

He founded his Menlo Park-based namesake firm in 2004 to focus on early-stage companies. Khosla’s success owes partly to his willingness to consider promising startups in a wide range of sectors including artificial intelligence, biomedicine, and robotics. His most prominent early investments include OpenAI, DoorDash, Instacart, Affirm, and Impossible Foods.

A keen eye for spotting entrepreneurs with transformative visions helped grow Khosla Ventures’ Assets Under Management to $15 Billion. At age 70 Khosla still retains a healthy appetite for betting on the future. In February 2025 the firm sought capital for three new venture funds totaling $3.5 billion. Half of that will be invested in Khosla’s ninth core venture fund, while $1.1 billion is slated for late-stage startups and $650 million for seed-stage projects.

The foundation for Khosla’s venture capital career was laid by his big early success as an entrepreneur. In 1982 he co-founded Sun Microsystems to pioneer open systems and commercial RISC processors. The company was acquired in 2010 by Oracle for $7.4 billion.

Khosla earned a bachelor’s degree in electrical engineering from the Indian Institute of Technology Delhi in 1976, followed by a master’s in biomedical engineering from Carnegie Mellon University in 1978, and a 1980 MBA from Stanford.

Venture Capitalist Alfred Lin Bet Early on OpenAI, Air B&B

Vinod Khosla's Venture Capital Fortune Blossomed Early from Sun

Asian American Success Stories

- The 130 Most Inspiring Asian Americans of All Time

- 12 Most Brilliant Asian Americans

- Greatest Asian American War Heroes

- Asian American Digital Pioneers

- New Asian American Imagemakers

- Asian American Innovators

- The 20 Most Inspiring Asian Sports Stars

- 5 Most Daring Asian Americans

- Surprising Superstars

- TV’s Hottest Asians

- 100 Greatest Asian American Entrepreneurs

- Asian American Wonder Women

- Greatest Asian American Rags-to-Riches Stories

- Notable Asian American Professionals